You spend a lifetime building a portfolio of financial investments which is productive and remunerative so that you may reap the benefits of their returns later. So, when faced with an unexpected liquidity requirement, why should you dilute your investments?

Tide over your liquidity requirements by availing instant loans from JM Financial Products at low interest rates, against your portfolio without the need to actually sell them. We offer loans for a portfolio of investments including shares, mutual funds and bonds.

You can count on us to be your benefactor in times of needs, as our loans can be used to cater to legal and legitimate borrowing requirements, business purpose, short term working capital requirements or meeting family obligations like marriage, higher education of self or children, medical expenses, etc.

All this while you still enjoy the corporate benefits accrued on the portfolio during the Loan tenure.

Features

-

Low Margin requirement :

Loan against shares and equity mutual fund is offered up to 50% of the market value/the Net Asset Value (NAV) and Bonds up to 90% of the value of bonds.

-

Low Interest :

The rate of interest is amongst the best in the industry. It is charged only on the amount utilized and not the entire loan sanctioned.

-

Loan Amount :

Loans are granted as high as Rs. 10 crores against the pledged securities from the approved list as prescribed by RBI and/or JM Financial.

-

Loan Type :

Loans are offered as a Term Loan or Flexi Loan.

-

Tenure :

In case of Term Loan, it will be offered for a certain period like 3, 6, 9 & 12 months and in case of Flexi Loan it can be up to an extended tenure of 12 months and can be renewed for further tenure subject to satisfactory review of your account.

-

Repayment :

In a Term Loan the principal will be payable at the end of the tenure. In a Flexi Loan repayment/disbursement up to the sanctioned amount can be done at any time during the tenor of the loan. Interest under both type of loans will be payable monthly.

-

Instant Loan Processing :

Simple and instant processing of online applications within 48 hours. Track your applications as they get processed online.

-

Top-Up Facility :

Option to avail additional finance on your current loan by pledging more shares, mutual fund or bonds.

-

Security Swap :

Flexibility to swap securities of equivalent or greater value as per market outlook while enjoying the benefits of dividends, bonus and rights issues.

-

Depository Participants Across India :

Pledge securities held in demat accounts with any depository participant enrolled

with NSDL or CDSL

-

Low Processing Fees :

Avail our loan services at one of the lowest processing fees.

-

No Extra Charges :

No foreclosure and prepayment/part-payment charges.

* Terms and Conditions apply

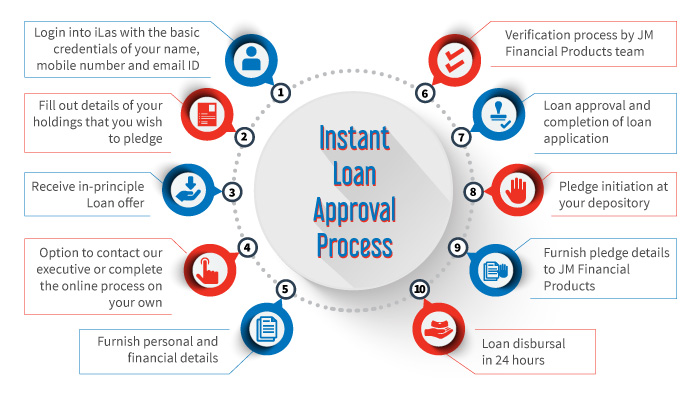

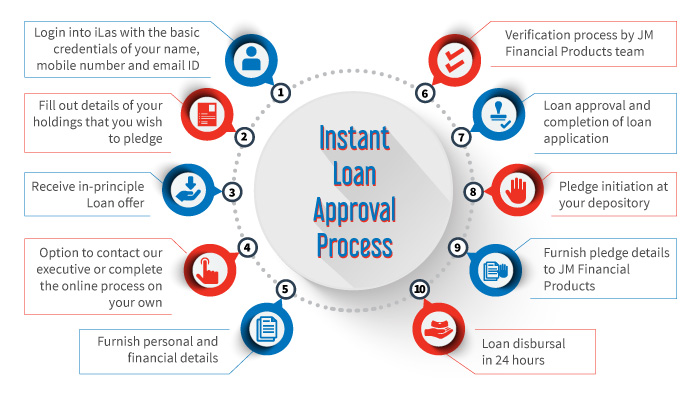

Instant Loan Approval Process

Get instant loan against your securities through these simple steps.

For further information contact us at jmf.ilas@jmfl.com

Or Send an SMS ILASJMF <space>Name<space>City to 91-92120156156